- #UNITED INDIA INSURANCE BIKE RENEWAL HOW TO#

- #UNITED INDIA INSURANCE BIKE RENEWAL DRIVER#

- #UNITED INDIA INSURANCE BIKE RENEWAL REGISTRATION#

- #UNITED INDIA INSURANCE BIKE RENEWAL LICENSE#

To do the same, the policyholder needs to enter their policy number and vehicle registration number and follow the instructions as directed on the website. The policyholder can register his/her motor insurance claim online through the official website of United India Insurance Company.

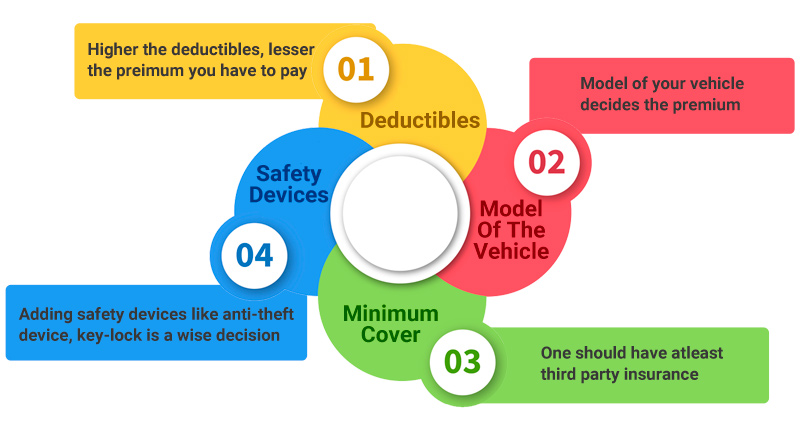

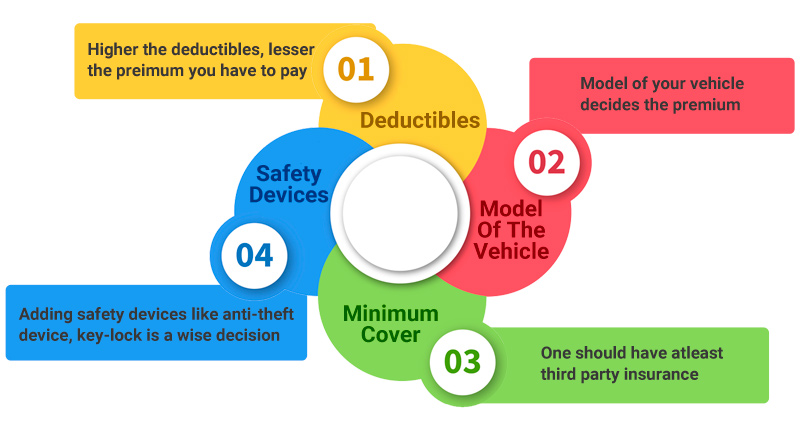

Electrical / Electronic Fittings: Electrical and electronic fittings that do not come default with the manufactured vehicle can be covered by paying an additional premium of 4% on the cost of such installations. Personal Accident Cover: Personal accident cover can be opted for named or unknown individuals travelling with the rider. Extension Of Geographic Area Covered Under The Policy: The coverage of the policy can be extended to countries including Bangladesh, Bhutan, Nepal, Pakistan, Sri Lanka, and Maldives by paying a certain amount of premium in addition to the base premium. The coverage can be enhanced by opting the following covers: The coverage offered under United India two-wheeler insurance policy can be extended by payment of additional premium. A discount of 331/1% on the tariff rates applicable if the member uses their vehicle within the insured’s premises or sites. A discount of 50% can be availed on OD premium for vehicles designed for use of physically or mentally challenged individuals. A discount of 2.5% can be availed on the Own Damage (OD) premium by installing an ARAI (Automotive Research Association of India) approved anti-theft device to the vehicle. 5% discount on own damage premium (up to Rs.50 for two-wheelers) for members of Automobile Association. The percentage of NCB is subject to the number of claim-free years. A No Claim Bonus can be availed in the range of 20% to 50% if the policyholder has not made any claim on their motor insurance policy in the preceding years. Claims made for vehicles used against their limitations of use under the policyĭiscounts Available On Purchasing United India Two-Wheeler Insurance Policy. Claims made outside the geographical area covered under the policy. #UNITED INDIA INSURANCE BIKE RENEWAL LICENSE#

Damage caused to the vehicle by a rider not holding a valid driving license. Damage caused to the vehicle due to a person driving the vehicle under the influence of alcohol or drugs. Mechanical or electrical breakdown of the vehicle. Depreciation in the value of the vehicle due to normal wear and tear. Drunken driving, war perils, and nuclear attack.

The following are not payable under the liability only policy offered by United India Insurance Company.

A Beginner’s Guide to Two Wheeler InsuranceĮxclusions Under United India Two-Wheeler Insurance Policy. #UNITED INDIA INSURANCE BIKE RENEWAL HOW TO#

How To Get NOC For Bike Transfer From One State To Another. Documents Required To Purchase New Two Wheeler. How to Cancel Two Wheeler Insurance Policy?. Zero Depreciation Cover for Bike Insurance. Steps Involved in Two Wheeler Ownership Transfer. 6 Benefits of Two Wheeler Insurance Renewal. Third Party Two Wheeler Insurance In India. How to Calculate Two Wheeler Insurance Premium in India.

Paperwork Required When You Buy a Used Motorcycle.Know more about Bike Insurance Related Articles

Analyse the number of advantages of the policies from the video below and choose the one that is most suitable for you and your motor vehicle. United India Two Wheeler Insurance also offers the minimum third-party liability cover. It is mandatory to at least have a liability-only cover for your motor vehicle as per the rules of the government. United India Two Wheeler Insurance offers insurance policies that provide comprehensive protection for your motor vehicle. Benefits of United India Two Wheeler Insurance United India Insurance Company offers various insurance plans for two-wheelers that cover vehicle owners/riders against unforeseen situations causing loss or damage to their vehicles or a third person and their properties. United India Two-Wheeler Insurance Policy

#UNITED INDIA INSURANCE BIKE RENEWAL DRIVER#

Personal accident cover offers protection to the owner or driver of the vehicle in case of an untoward incident

50% discount is offered on OD premium for vehicles designed for use by mentally challenged and handicapped persons. Members of the Automobile Association are given discounts of up to 5% of the OD premium. Discounts are provided for vehicles with Anti-theft devices. Vintage Cars get a discount of 25% on the OD rates. Claims made when the vehicle is driven by someone without a valid driving licenseĪny liabilities due to injury or property damage to third parties. Losses incurred by driving under the influence of alcohol or any other intoxicants. All damages incurred due to man-made disasters such as riots or theft. Covers damages incurred due to natural disasters such as earthquake or flood. United India Insurance Two-Wheeler Insurance – An Overview

0 kommentar(er)

0 kommentar(er)